By A. Malek Hammami and Zhengfei Guan

The United States is a major blueberry producer. The value of production in 2021 reached $1.1 billion, according to the U.S. Department of Agriculture Economic Research Service (USDA ERS). USDA statistics show that total U.S. blueberry production in 2022 was 622 million pounds.

The Pacific Northwest states of Oregon and Washington lead in blueberry production, collectively accounting for over 50% of the U.S. total, owing to their conducive climate in the production season that spans from June to September. In 2022, Washington recorded production of 180 million pounds, while Oregon contributed around 160 million pounds, representing 30% and 26% of national production, respectively.

Other major producers are California, Georgia, Michigan, North Carolina and New Jersey. Florida ranked eighth nationally, producing 26 million pounds of blueberries in 2022. Thanks to its early season, almost all Florida production (99%) goes to the fresh market. The fresh percentage for northern states is much lower: 50% for Michigan and Oregon, and 30% for Washington, according to USDA ERS.

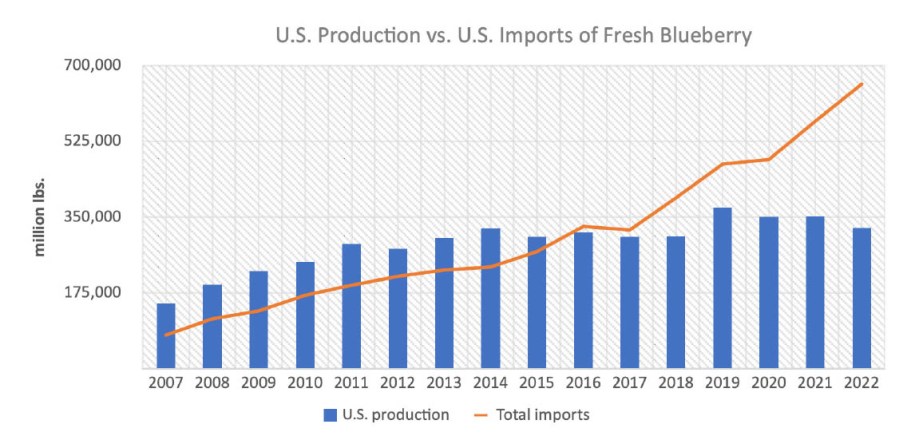

Fresh blueberry production in the United States (Figure 1) saw a period of rapid expansion leading up to 2014. In 2007, production was 150 million pounds; this quantity more than doubled by 2014, reaching 324 million pounds. But production has stagnated since 2014.

Sources: U.S. Department of Agriculture (USDA) National Agricultural Statistics Service and USDA Foreign Agricultural Service, 2023

In stark contrast, U.S. imports of fresh blueberries have rapidly accelerated, growing eightfold from 77 million pounds in 2007 to 657 million pounds in 2022, a volume twice as large as total U.S. production. A major shift occurred in 2016, marking the year when U.S. fresh blueberry imports surpassed total domestic production. In 2022, 90% of U.S. fresh blueberry imports originated from three countries: Peru (49%), Mexico (22%) and Chile (19%). The rapid growth of imports has posed major challenges to the domestic industry.

PERU PUMMELING NORTHERN STATES

The bulk of the domestic blueberry production is concentrated in the northern and northern Pacific states, including Michigan, Washington and Oregon. The peak of their production season during late summer months overlaps with the market window of Peruvian blueberries (mid-August to mid-February), resulting in intense competition and troubles for these states.

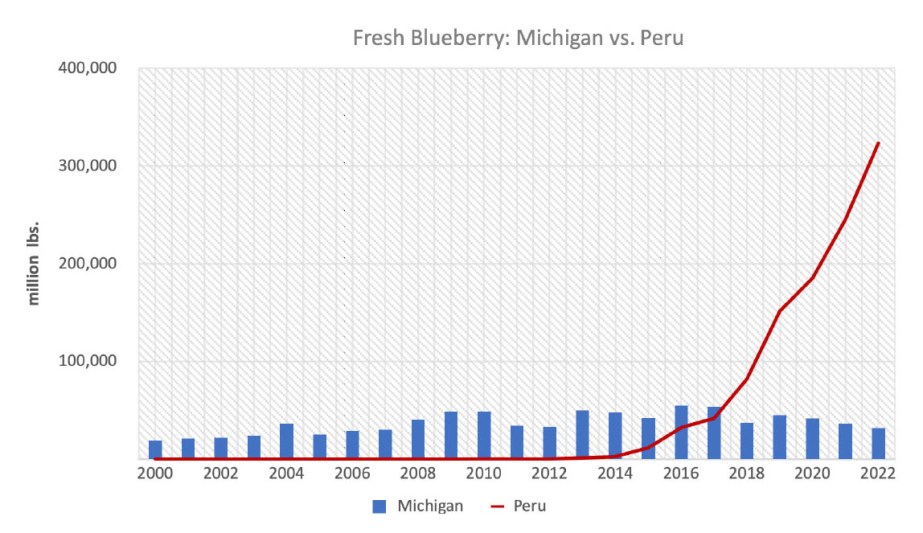

Michigan was the leader in U.S. fresh blueberry production until it was overtaken by Oregon and Washington in 2017. Michigan reached its peak production in 2016, producing 55 million pounds of fresh blueberries (Figure 2). However, the good days were quickly over when blueberries imported from Peru started to dominate the market.

Sources: U.S. Department of Agriculture (USDA) National Agricultural Statistics Service and USDA Foreign Agricultural Service, 2023

Prior to 2014, imports from Peru were almost non-existent. The imports started to take off in 2015 and saw an exponential growth in the following years, skyrocketing to a whopping 323 million pounds in 2022, 10 times higher than Michigan production (32 million pounds). The meteoric rise of Peruvian imports has caused tremendous pressure for Michigan growers, resulting in a 43% drop in their fresh blueberry production from the period of 2016 to 2022.

MEXICO HARMING SOUTHERN STATES

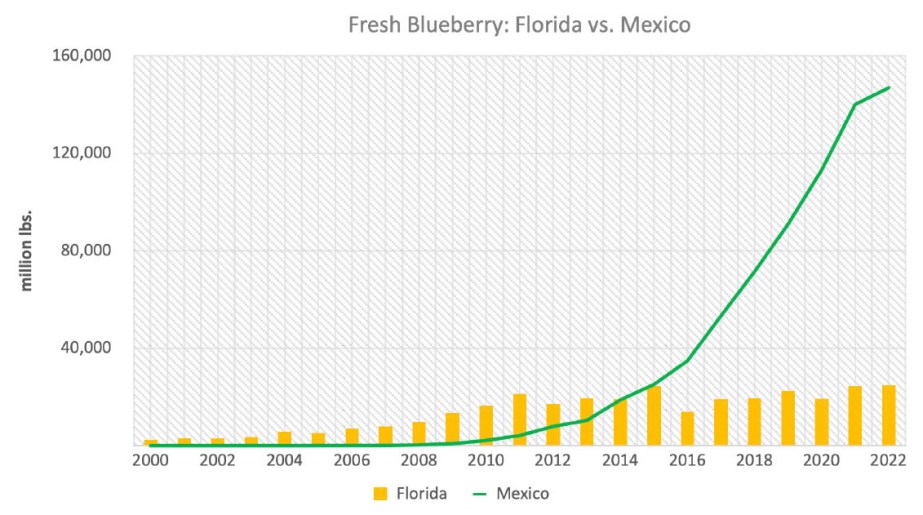

Mexico has an extended season (September to June) that covers the market windows of the U.S. southern states. Mexico has emerged as a direct competitor for Florida, which once commanded high prices during an early season (March to May) with limited competition. That changed about 10 years ago when Mexican imports started to surge, increasing from less than a million pounds in 2009 to 147 million pounds in 2022 (Figure 3). The exponential growth has had a significant impact on the Florida blueberry industry. Following a sustained period of steady growth in preceding years, Florida blueberry production has remained stagnant since 2012.

Sources: U.S. Department of Agriculture (USDA) National Agricultural Statistics Service and USDA Foreign Agricultural Service, 2023

PLUMMETING PRICES

The fierce competition has led to a free fall in prices in Florida, plummeting from a high of $6.30 per pound in 2005 to $2.60 in 2019 before the COVID-19 outbreak (and $3.20 in 2022 due to post-pandemic inflation).

Michigan blueberry prices also experienced declines in the years leading up to the pandemic, but it was less pronounced compared to that of Florida blueberries, probably due to the significant declines in production, which likely mitigated the extent of market price reactions.

The dramatic growth of imports has caused challenges to the U.S. domestic industry, particularly impacting Michigan and southeastern states such as Florida and Georgia, prompting blueberry growers to seek trade remedies. In October 2020, the U.S. International Trade Commission (USITC), upon the request from the Office of the U.S. Trade Representative, initiated a global safeguard investigation under the provisions of Section 201 of the Trade Act of 1974. However, the USITC concluded in February 2021 that increased imports were not a substantial cause or threat of serious injury to the domestic industry.

A. Malek Hammami is a postdoctoral associate and Zhengfei Guan is an associate professor, both at the University of Florida Institute of Food and Agricultural Sciences Gulf Coast Research and Education Center in Wimauma.